Investigating Uniswap's Top Traders

Who are the sharks picking LPs off in the Uniswap ETH/USDC pools?

How much are they making for keeping markets efficient?

A investigation on Uniswap's best and worst traders.

Background

I analyzed all Uniswap V3 trades for the ETH/USDC pools INCLUDING gas. I then calculated a markout using different time horizons of the Binance last traded price to measure profitability. Please refer to a previous for additional context:

Uniswap Statistics

In earlier analyses, we discovered Uniswap V3 LPs lost ~$100M relative to hodling at an aggregate of 2-3 basis points. Uniswap V3 swappers, interestingly, also lost ~$125M in markout PnL after gas.

This is an aggregate -2.5 basis point loss.

Uniswap swapper have paid almost $200M in gas fees since inception on almost $400B of volume traded If you add back gas costs to the swapper's net PnL, they are actually in the green by about $75M.

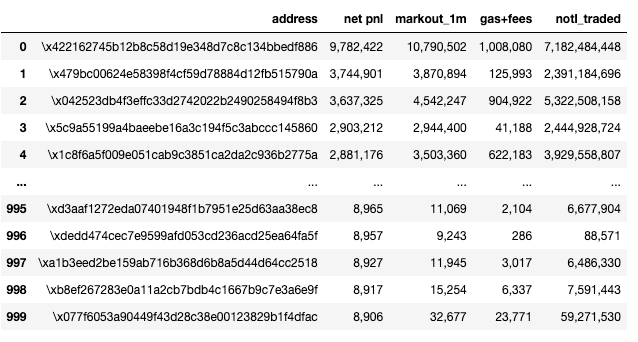

There were 688,662 unique swappers in the dataset. The best 1,000 swappers have made over $200M in net PnL after gas.

The worst ~100,000 swappers account for nearly all of the $350M in losses.

Of the sharks, there are two profiles. One type rotates wallets after a few months while the other keeps trading in the same wallet.

The most winningest trader on Uniswap has netted around $10M in 1m Binance markouts net of gas and fees, with most of his/her pnl concentrated in the few months after V3 in May 2021.

https://etherscan.io/address/0x422162745b12b8c58d19e348d7c8c134bbedf886

The top 1,000 swappers paid over $55M in gas fees for $200M in profits. This nets out to be ~7.4 bps of aggregate 1m markout profits. This is quite juicy! Market makers are typically happy with 1 basis point on their trading.

In our last thread, we pointed out that the $175k- $2M size trades were the most toxic for LPs. Note that net of gas, this still holds true! Just much less.

It's no coincidence where the distribution of trade size from the top 1,000 traders is centered.

The top 1,000 traders typically net a few hundred dollarinos per trade after gas.

The top 1,000 traders aren't actually paying that much in gas to pick the LPs off. The trade doesn't really seem that expensive latency wise? Perhaps the CEX infrastructure is the most important part.

Others have mentioned that most of the extra gas is paid in the form of tips to validators, which this query doesn’t capture. On the TODO to investigate that!

Who are the worst traders? Why are they bleeding so much money? The worst 1,000 lost $177M in 1m markouts.

Most of them are trading tiny size (<10k) and losing ~$100 per trade in markouts.

Here are some of the worst addresses:

1. Maker Vault Owner (liquidation flow) -$5.9M https://etherscan.io/address/0x22de0b5c40f012782a667ccdaa15406ba1201246…

2. pennilesswassie.sismo.eth alt? -$5.6M https://etherscan.io/address/0x9c5083dd4838e120dbeac44c052179692aa5dac5…

Data Sources

Shoutout to @DuneAnalytics, @afletsas, @susmeetjain, and the Dune team for their help gathering the data.