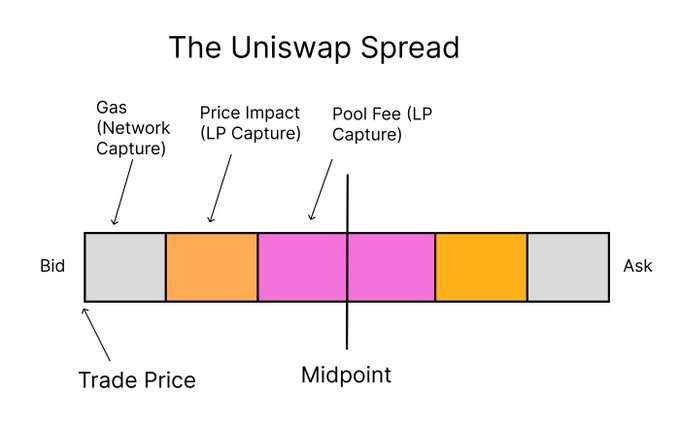

The gas fees on each trade can be viewed as part of the bid-ask spread that Ethereum network captures on every Uniswap trade.

This is akin to "capture" of an exchange , measured by the fees charged for taker orders minus the rebate given to maker orders.

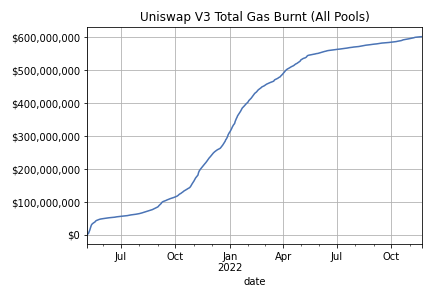

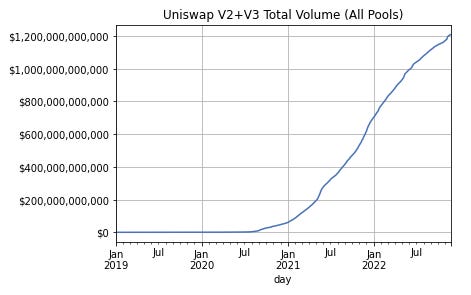

Uniswap traders have paid over $600M in gas fees over its lifetime (marked to market at time of trade). Uniswap has traded a lifetime volume of over $1.2 Trillion since its inception. This equates to a lifetime network capture of ~5 bps.

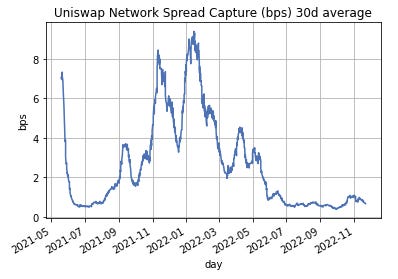

This is the network's rolling 30d spread capture on Uniswap. This capture grows when blockspace is in high demand. As things have cooled, network capture rests at under 1 bp In comparison, Binance's ETH/BUSD pair has a capture of 1.07 bps for its top fee tier.

If we assume that most of the volume price-sensitive arb flow, that means gas costs come directly out of the LP's pocket in retained spread. Improving gas efficiency in infrastructure design could save LPs a lot of gas, especially when blockspace is in high demand.

Uniswap LP losses are subsidizing a large portion of Ethereum network security incentives in the form of gas (and MEV) for validators. How long can this bleed sustainably last?

Some open questions:

1. How can we increase gas efficiency for on-chain trading?

2. Should we redistribute validator incentives back to LPs so we don't skin the sheep? 3. What are some ways we can increase profitability for LPs?

I'm not sure about the first two questions, but I'll try to question 3. One way is using a dynamic fee policy that widens spreads in periods of high volatility. @0xfbifemboy and @0xdoug of @CrocSwap have done good analysis on this.

This operates under the assumption that toxic arbitrage flow is more price sensitive than retail flow. Pools lose the most money in times of volatility. Wider fees in such moments could shift the net equilibrium of arb:retail volume such that the LP turn a profit.

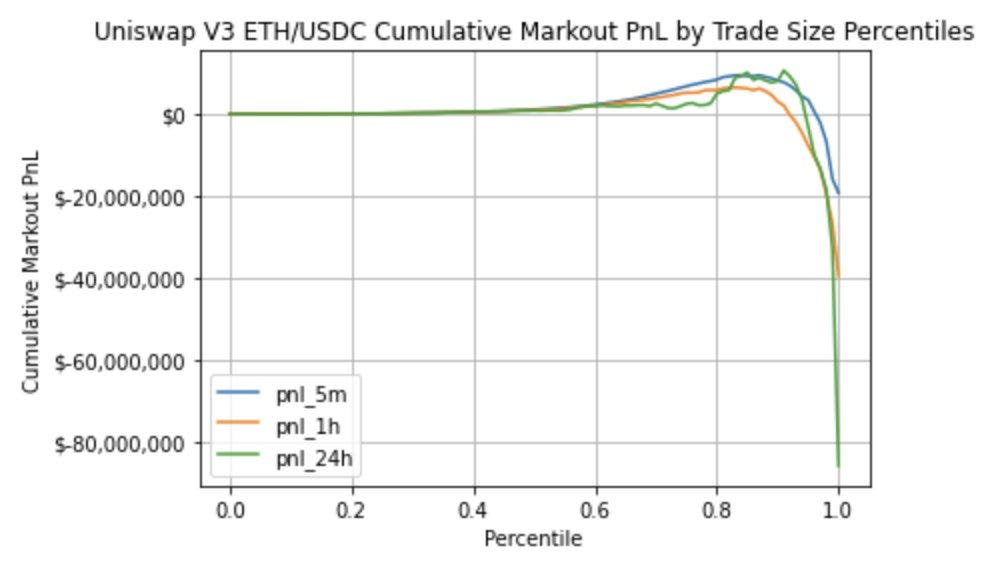

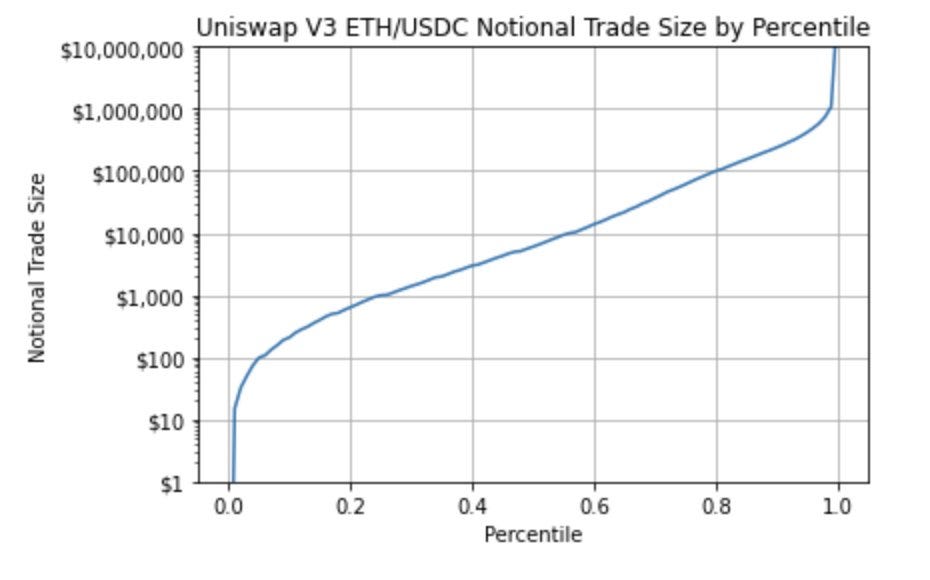

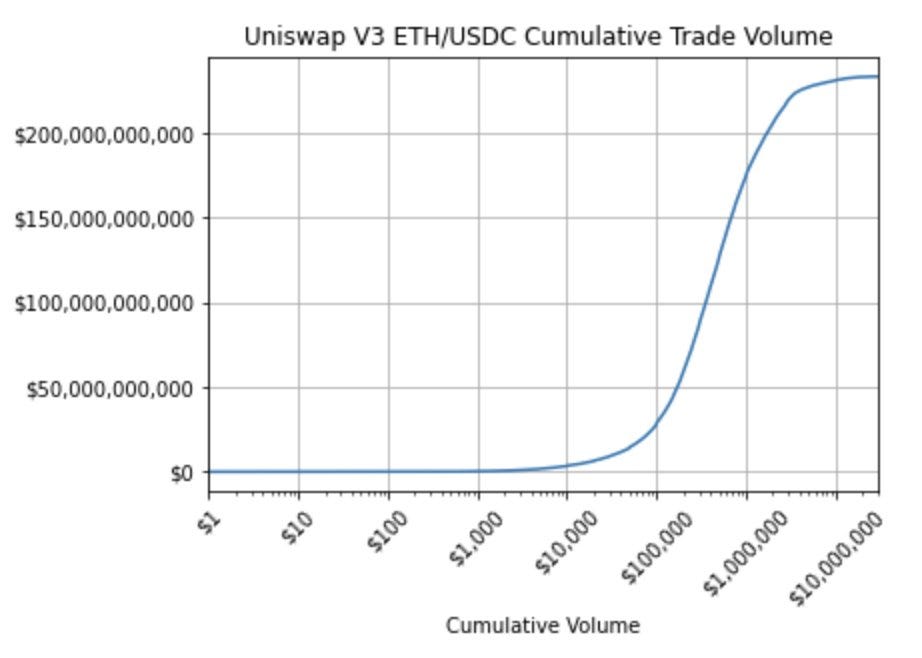

Another thing we could do to shift the equilibrium is to segment our order flow. Aggregating the cumulative markouts on Uniswap by swap size shows 3 profiles

Retail: < $175k swaps

Arbooor: $175k - $4M

Hackers: $4M+

Interpretation:

Retail trades (<$175k) are net positive to LPs to the tune of 5bps (quite juicy ).

Arbooor trades ($175k - $4M) are quite toxic to LPs.

Large trades ($4M+) are positive probs due to price insensitive flow from hackers (e.g. Nomad hack)

Over 85% of trades on Uniswap have net positive markouts for LPs

Larger trade sizes usually correspond when spot prices move violently, correlating with more adverse selection for LPs What if LPs just... only allowed the smaller flow and told the toxic flow to buzz off?

If Uniswap LPs were clairvoyant and could gate access for only "retail" flow, it could have made ~$10M+ in the past year net of impermanent loss.

More open questions: Should we try to segment user flow? How do we trade off permissionless principles with the Tragedy of the Commons?

If the answer is yes, how can we segment users? Can we use transaction history to establish on-chain identity? Is it sufficient to limit the amount of volume from a single address? How do we prevent arbitrageurs from posing as retail like wolves in sheep's clothing?

Lots of questions, not many answers... yet. If you are working on these problems or have any thoughts, please comment below and let's start a discussion :)