Perpetuals 101

Table of Contents

What is a perpetual?

What affects funding rates?

How are funding rates implemented?

What is a perpetual?

A perpetual futures contract is a financial derivative that tracks the price of an asset that allows traders to speculate on the future price movement.

The market price of the perpetual is known as the “mark” and while the reference price of the underlying asset is known as the “index”.

Funding rates

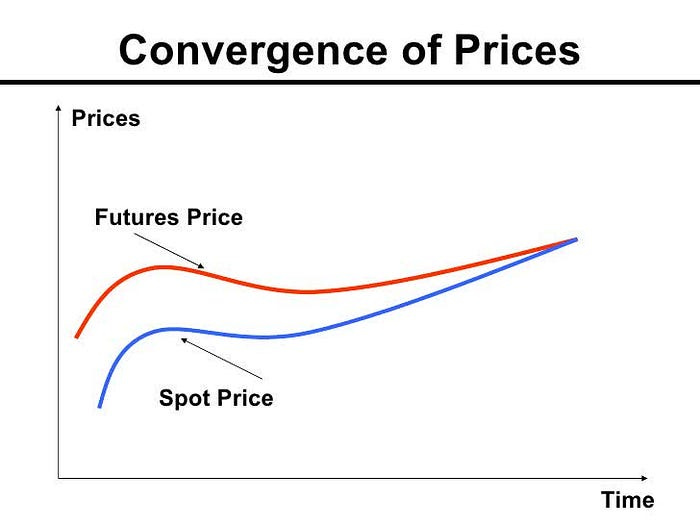

There is a mechanism called the “funding rate” which helps incentivize the market price of the perpetual contract to converge to the price of the underlying asset.

If the perpetual is trading higher than the index, then traders who have open long positions owe the short positions a payment that corresponds to how dislocated the perpetual price is from the index (positive funding rate).

If the perpetual is trading lower than the index, then traders who have open short positions owe the long positions a payment (negative funding rate).

if perpetual_swap_price > underlying_price

=> funding_rate is positive (longs pay shorts)

if perpetual_swap_price < underlying_price

=> funding_rate is negative (shorts pay longs)Example

SOL is trading at $20

SOL-PERP is trading at $21

Funding Rate = 5%

Since SOL-PERP is trading at $5 higher than its index, the funding rate is positive 5% indicating that the traders who are long the perp are paying the traders who are short a funding rate of 5%.

If the price of the perpetual ever gets too out of line with the index, this incentivizes arbitrageurs to take on the position in the direction that is receiving funding and hedge it by trading the other direction in the underlying.

In the above scenario, a trader could short the SOL-PERP and long SOL and earn the funding rate on a risk-free position. This is known as basis arbitrage.

The sell pressure on the expensive asset coupled with the buy pressure on the cheap asset leads to price convergence.

When the difference between the perpetual and the underlying a.k.a. basis disappears, the trader then needs to unwind position.

The arbitrage basis trader gets compensated for assuming the risk that the basis position flips direction.

What affects funding rates?

Perpetuals offer great capital efficiency because they allow traders to use leverage. Some exchanges offer up to 100x leverage on perpetuals trading. This demand for leverage is what affects the funding rate.

If there is a large demand to be leveraged long on the asset, then perpetual will trade at a premium to the underlying and cause the funding rate to be positive.

If there is a large demand to be leveraged short on the asset, then the perpetual will trade at a discount to the underlying and cause the funding rate to be negative.

Some people use funding rates from perpetual markets as a short term predictor on future price movements.

How are funding rates implemented?

There are two different dials that can be tuned with the funding rate:

Funding Period

Funding Frequency

The typical settings are a 24h Funding Period with a 1h Funding Frequency.

The funding rate is typically the difference between the mark and the index. The funding period affects over what period of time this funding gets paid. In the above example, if SOL-PERP = $20 and SOL-SPOT = $21, then the $5 in funding is paid out over a period time that equals the funding period.

In typical cases, the $1 would be paid out over 24h with each funding payment happening every hour with the payment = 1/24 * 5.

If you set the funding period too long, the perpetual can start to trade at a very dislocated price to the index because there’s less of an incentive for basis arbitrageurs to push the prices back in line since they would have to carry the basis risk for a longer period of time.

If you set the funding period too short, then nobody will trade the perpetual because there’s it’s too punitive of a price to pay in the case the funding rate flips sign.

The funding frequency effects how often the funding payments are paid.

Some exchanges like to do one discrete payment whereas others continuously pay the funding. Too discrete of funding payments can cause prices to converge less, and can be prone to gaming.

Too continuous of funding payments can lead to integer underflow because the funding payments might be too small and require too much precision from the processing hardware.

Let me know if you have any questions in the comments