Is GMX the robin hood of DeFi? A dive on:

order flow toxicity on GMX

protocol design mechanisms that protect retail LPs

GMX's parallels to TradFi analogs

the potential for economic exploitation

the meta of DeFi protocols and its future direction

GMX is a DeFi trading protocol on Arbitrum that allows LPs to deposit funds and provide leverage to perpetuals traders GMX's LPs make money by taking the other side of every trade and charging fees and funding

@BytetradeLab wrote an excellent primer here.

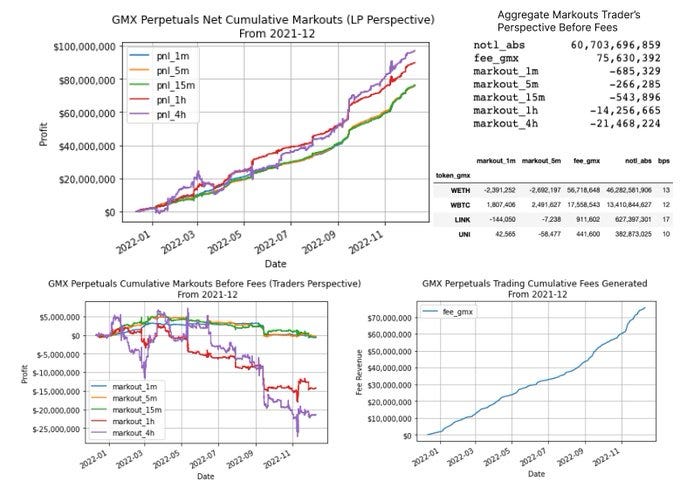

GMX revenues are split 70/30 amongst the LPs and the GMX token holders The protocol has generated almost $100M in net PnL in 15 months since its inception in 2021-08.

How can passive LPs in permissionless protocols win in this day and age?

We analyzed the "markouts" of all GMX trades from 2021-12 to measure the order flow toxicity.

GMX's traders are incredibly non-toxic, losing a whopping 11 basis points in 1 min markouts after fees

A reminder on what a markout is:

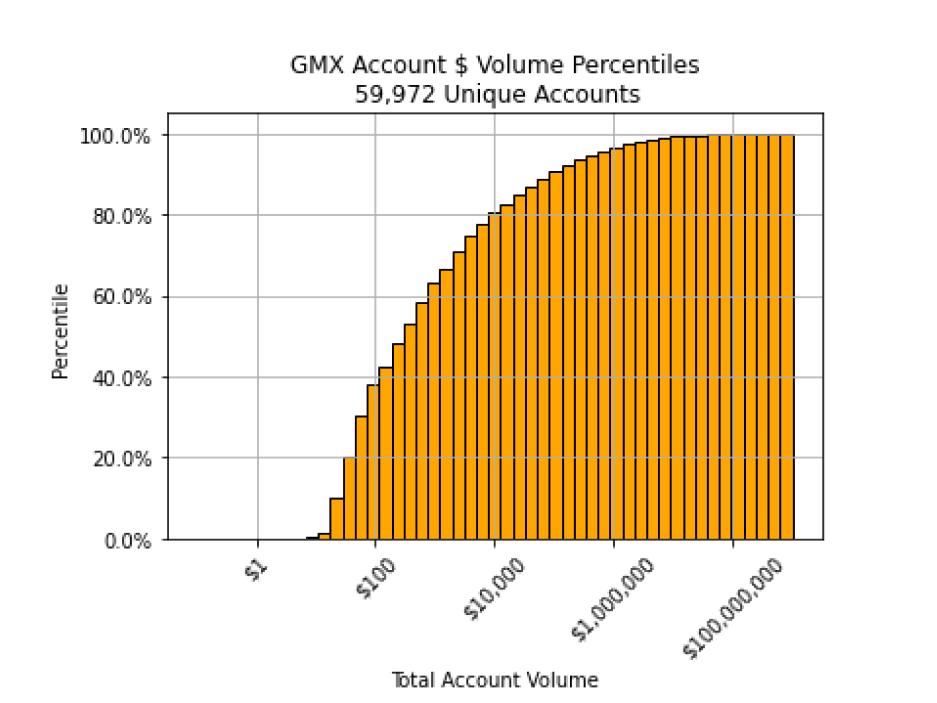

GMX had 60k unique users with the median account traded $350, while the mean account traded >$1M Toxicity increases with trade size, but only slightly (positive = toxic) Large trades before fees have no toxicity to the protocol.

GMX has clearly found an equilibrium between passive retail LPs and retail traders that has resulted in a revenue machine

Passive retail LPs in AMMs across DeFi can almost never win at scale What mechanisms has GMX implemented to tip the scales towards the LPs?

Price oracles

GMX relies on price oracles to bootstrap price discovery. This increases the efficiency of local price discovery by forgoing the need to pay $100M in EV from arbitrage like on Uniswap to keep prices in line with the fair price We'll talk tradeoffs later :)

Speed bumps

GMX trades take two transactions that utilize a 5 second speed bump to mitigate arbitrageurs from front-running oracle updates.

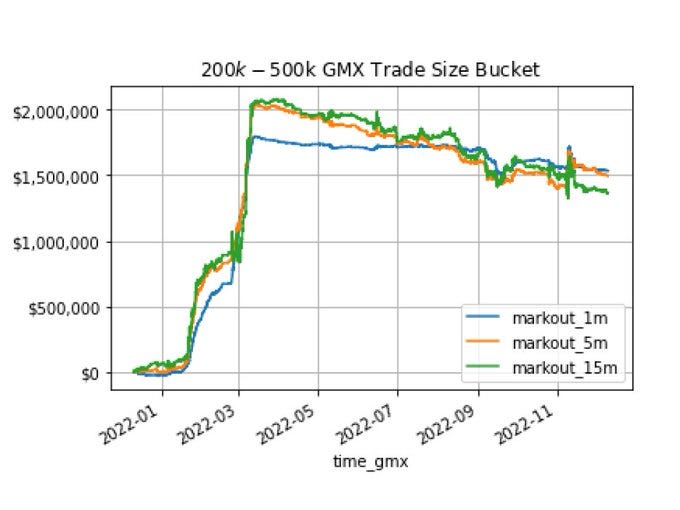

This change was introduced in April and reduced the amounts of direct arbitrage activity dramatically.

The little red blip from the trade size graph earlier was the result of an oracle front-running arbitrage trade signature that was effectively killed after the 5s speed bump was implemented A simple yet effective change.

High Fees

GMX trading fees are quite hefty , with 10 bps of exchange capture - slippage costs. This works out well for LPs in BTC/ETH trading against smaller orders where liquidity on the book is thick dYdX and Binance comparables assumes the user trades $1M/month.

Penetrative Marketing

Penetrative marketing campaigns and an effective referral program attract a steady supply of profitable retail traders. Who doesn't have a GMX reflink in their twitter bio nowadays?

These mechanisms help LPs by segmenting retail from arbitrageurs Oracles, speed bumps, large trading fees, and effective marketing campaigns filter retail traders from sharks.

GMX's business model is analogous encapsulates the full-stack retail trading business in US equities. GMX brings retail traders in like Robinhood and then takes the other side of their soft trades like Citadel Securities.

Zero slippage is the new zero commission trading.

GMX has a beautiful business model The protocol democratizes retail trading flow, taking profits from the HFT market makers and Ken Griffin's coffers and distributing it to the merry men of permissionless LPs and GMX holders the truest form of a Robin Hood.

Should you gigabid $GMX? Earnings of ~$40M with FDV of ~$450M = a multiple of 11x, a steal for a DeFi protocol? Perils on the horizon you should consider

1) The retail trading industry is cyclical

2) Economic exploits and scalability issues

3) Arbitrum airdrop

Retail Trading Volumes are Cyclical

We can look at Virtu as a case study, an HFT mm that's publicly traded and does ~25% of US retail volume P/E ratios are low (~5-6) because retail trading is fickle and competitive markets increase the risks of structural alpha decay.

Retail trading volumes shift quickly as narratives and incentives change Copycats and competitors steal market share and cause an oversupply of liquidity, a common occurrence across the DeFi metagame.

Retail traders have short attention spans Marketing campaigns and promotions to maintain interest gets notoriously expensive $HOOD the consumer app is still hemorrhaging money.

Scaling causes vulnerabilities

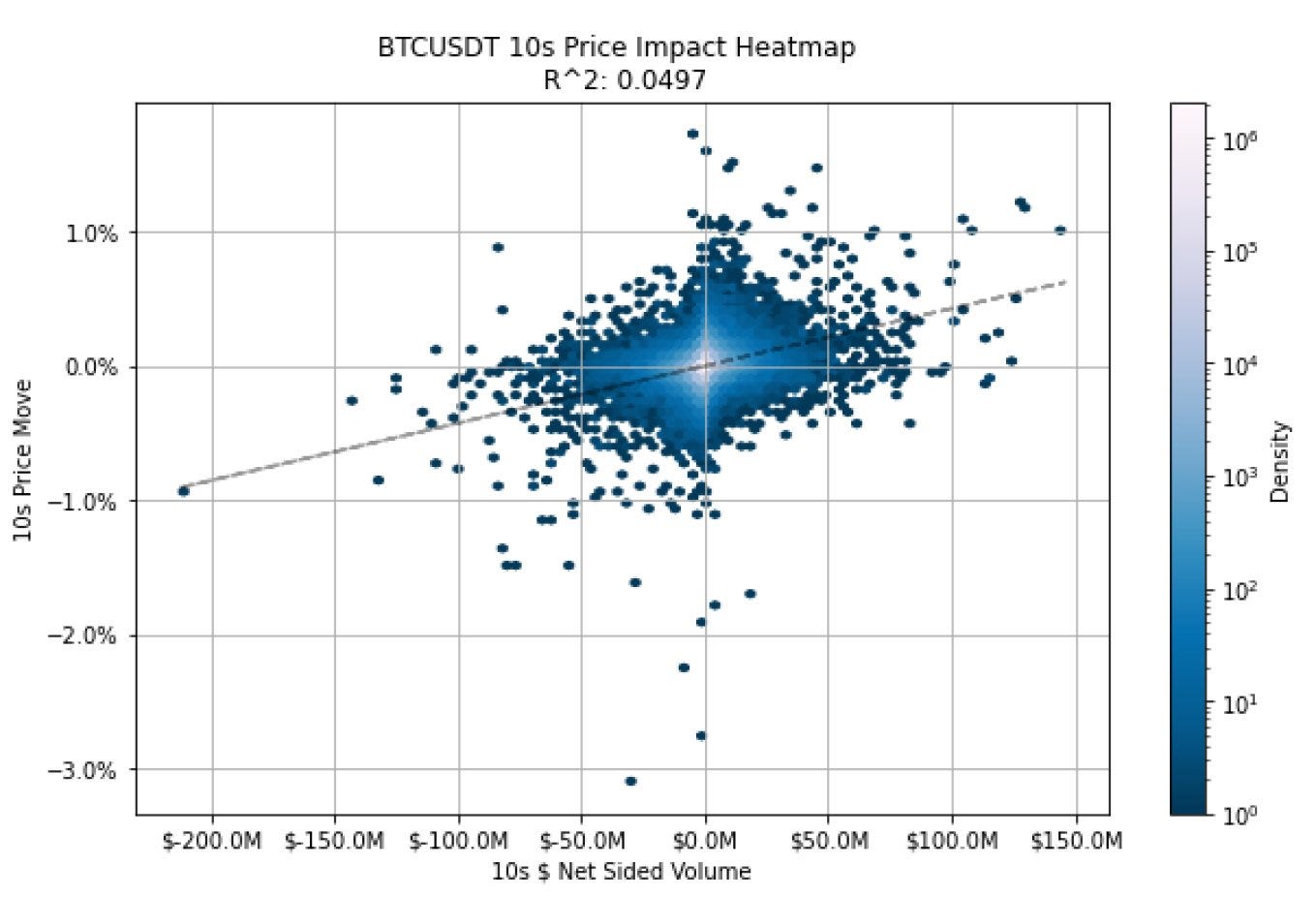

Price oracles are a double edged sword They are great at bootstrapping efficient local price discovery, but come with the curse of capacity ceilings for growth and introducing potential exploits.

I will add a caveat that it is prohibitively expensive to manipulate oracle prices via CEXes in a delta neutral manner to exploit on GMX. The AVAX exploiter likely lost money net of slippage and fees from the attack in September.

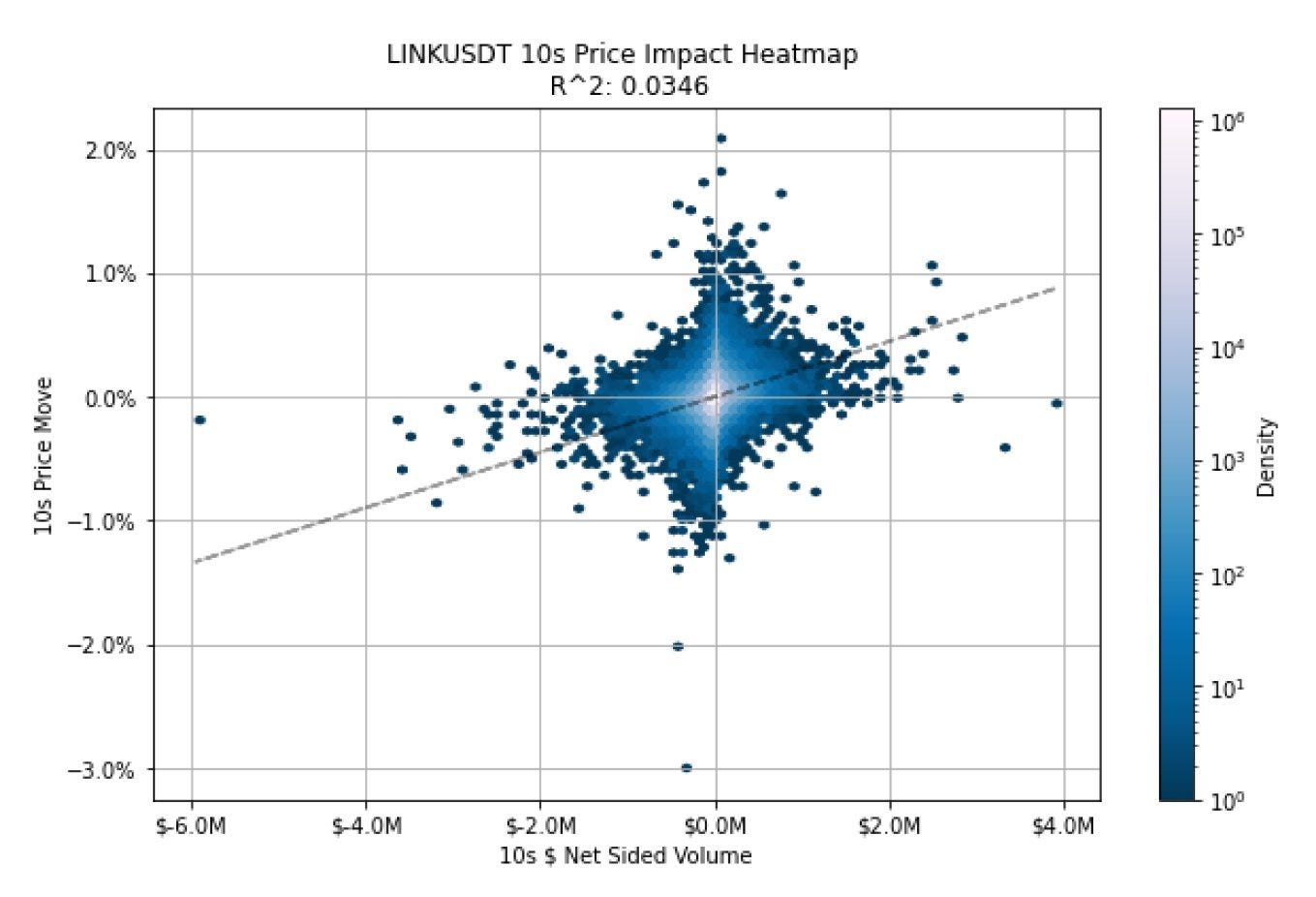

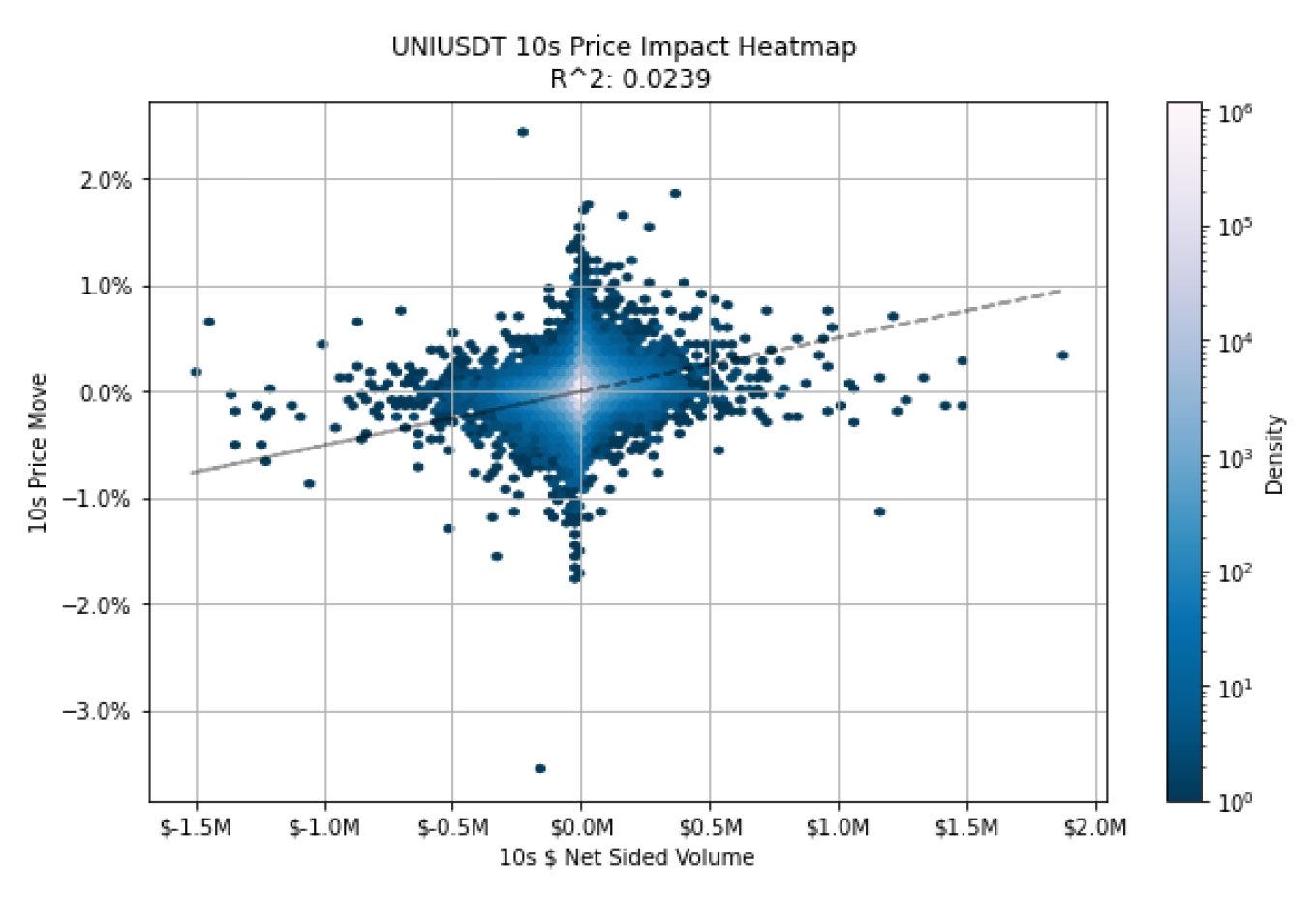

We made a crude market impact model regressing the 10s close-close log return against the 10s net sided volume on Binance to estimate costs in moving the market A 20bp manipulation (round trip GMX fees) in ETH would cost ~$20M. Perhaps too rich for our friend Avraham.

Any institutional level participant can exploit GMX anytime they are punting some deltas. Consider the following:

1. Su Zhu wants to buy $100M ETH in his new fund

2. Su max longs ETH in GMX for 0 slippage before slamming bid on Binance

3. Su closes GMX long for 1-2% profit

GMX has addressed this issue by introducing stricter OI limits. This doesn't entirely get rid of the issue and trades off scalability OI limits at 30-40% of AUM means capital inefficiency Marginal $GLP minted doesn't increase liquidity and dilutes the yield of existing LPs.

Arbitrum Airdrop

$ARBI I has been one of the most anticipated airdrops all year. With GMX as the premier protocol on Arbitrum, it's unclear how much activity has been implicitly incentivized with the future token airdrop.

A 2% airdrop at a $10B valuation would mean a potential $200M windfall for Arbitrum traders, more than making up for their trading losses Clear project evaluation can be difficult when factoring in 2nd order effects. Post airdrop will be a good test of robustness of sustainability.

GMX has found clear pmf and has built an enviable revenue model. Its success raises some existential questions on what DeFi should be and what we as a community should build towards. Those thoughts for another day~

Disclaimer: I am not affiliated with $GMX or any other competitor in any way, nor do I hold any $GMX tokens or any other competitor's tokens.